January 29, 2026

Keppel Ltd. has announced a strategic partnership with Aster to jointly assess the development of one of Asia’s first commercial-scale ethanol-to-jet (ETJ)…

January 27, 2026

The completion of the review by the White House Office of Management and Budget (OMB) marks a turning point for the long-delayed…

January 26, 2026

EcoCeres Inc. officially inaugurated its sustainable aviation fuel (SAF) production facility on Jan. 26 in Pasir Gudang, Johor, Malaysia, marking a landmark…

January 25, 2026

A Korean research team has successfully demonstrated an engineering pathway to produce Sustainable Aviation Fuel (SAF) from landfill gas generated by food…

January 24, 2026

At the World Economic Forum in Davos, a panel on clean fuels highlighted challenges in scaling sustainable aviation fuel (SAF), with executives…

January 23, 2026

Over the past three years, China’s export data for industrial-grade mixed oil (UCO) has sent an important signal that many have overlooked:…

January 23, 2026

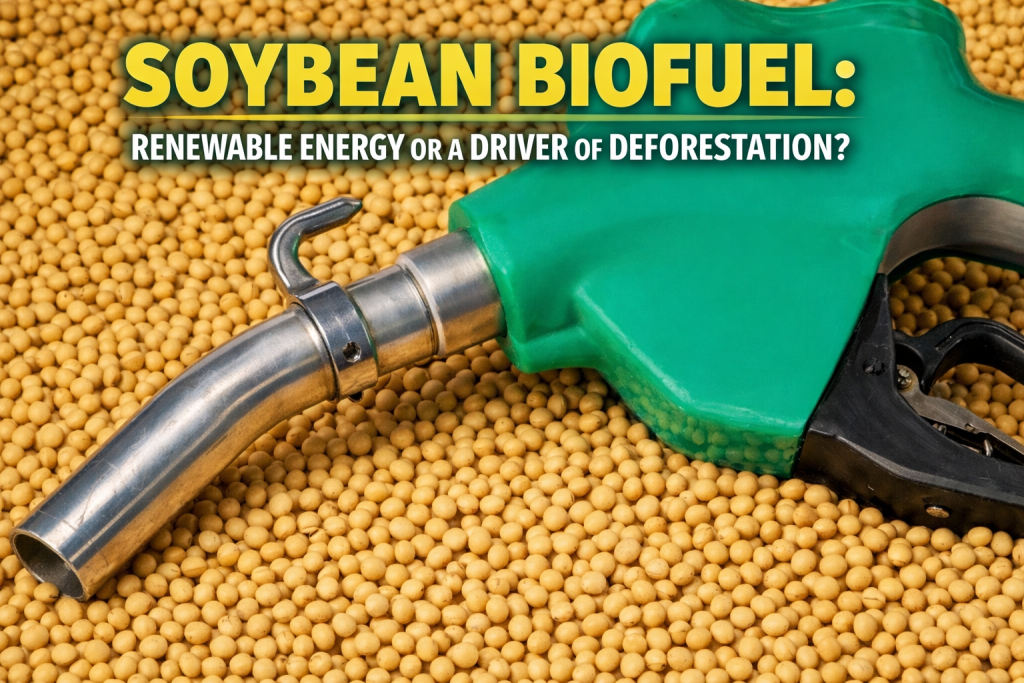

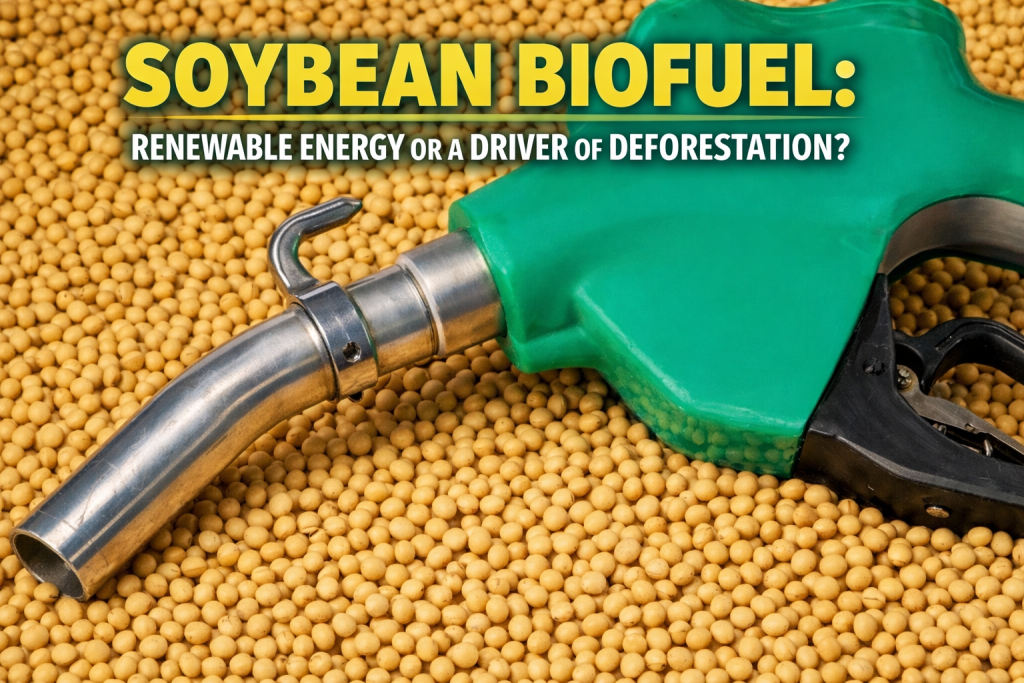

A recent study by the European Commission confirms that soy-based biofuels are a major driver of deforestation and should therefore no longer…

January 21, 2026

On January 20, 2026, the UK government announced £43 million in funding for green projects aimed at supporting the aviation sector, protecting…

January 20, 2026

Indonesia is preparing to introduce mandatory use of Sustainable Aviation Fuel (SAF) in its aviation sector, with initial implementation expected in 2026…

January 19, 2026

On January 19, Zhuoyue New Energy announced via its official WeChat account that its subsidiary, Zhuoyue New Energy (Thailand) Co., Ltd., recently…