February 7, 2026

According to a report by Hong Kong Radio on February 8, an industrial accident occurred at a biodiesel company in Tseung Kwan O. At…

February 3, 2026

Evandro Maggio, CEO of Toyota Brazil, announced on February 3 local time that Toyota will establish a biofuel laboratory in Sorocaba, São Paulo state,…

January 31, 2026

The growing debate over biodiesel imports has exposed deep divisions within Brazil’s fuel market and government. Fuel distributors are pushing for imported biodiesel as…

January 23, 2026

A recent study by the European Commission confirms that soy-based biofuels are a major driver of deforestation and should therefore no longer count toward…

January 19, 2026

In 2025, Ningbo-Zhoushan Port, China, reached a major milestone as its bonded marine biofuel bunkering volume surpassed 60,000 tonnes for the first time, making…

January 18, 2026

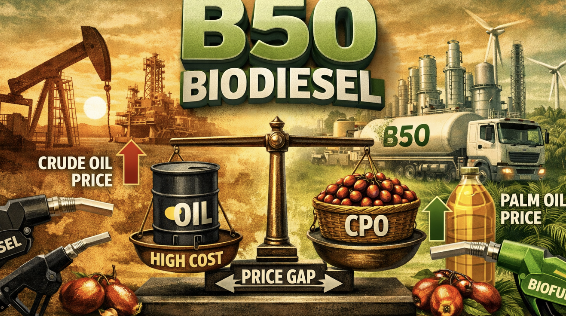

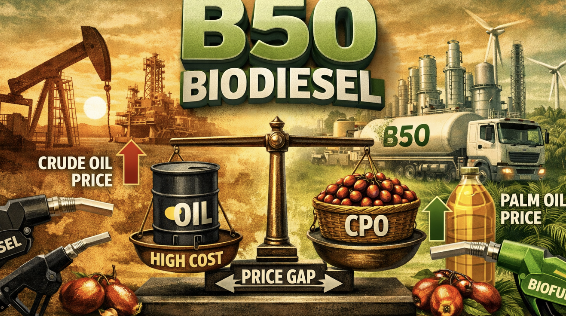

The postponement of Indonesia’s B50 biodiesel blending mandate has weighed on palm oil prices, dampening expectations for near-term demand growth from the energy sector.…

January 18, 2026

Vietnam is set to officially transition to E5 and E10 biofuels from June 1, 2026, following a long-term roadmap developed by the government and…

January 14, 2026

Indonesia will continue to implement its B40 mandatory biodiesel blending policy this year, while plans to transition to B50 remain under further study, Coordinating…

January 13, 2026

Indonesia’s plan to launch its B50 biodiesel mandate will depend on the price spread between crude oil and crude palm oil (CPO), a senior…

January 4, 2026

The Indonesian Ministry of Energy and Mineral Resources (ESDM) has set the January 2026 biodiesel Market Index Price (HIP) at IDR 13,631 per liter,…